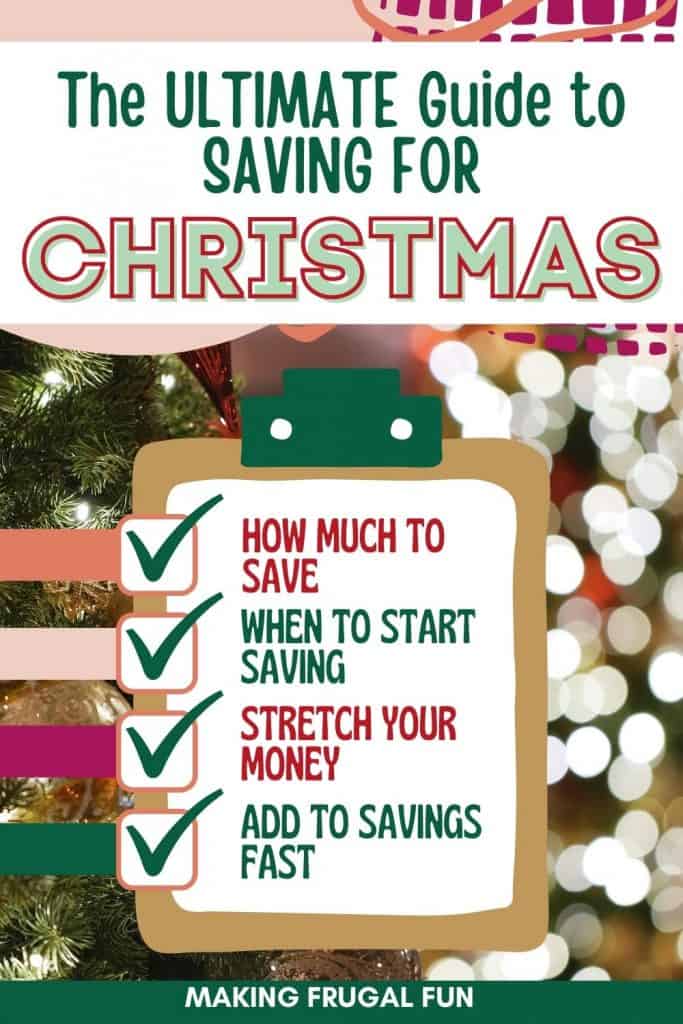

The holiday season is quickly approaching. As the weather changes from warm summer days to the cold brisk winter, we’re all excitedly awaiting Christmas time.

Not many people know this, but it’s best practice to start budgeting for Christmas time early on. This ideally means in the summer or early fall.

It’s important to note when calculating your own Christmas budget to focus on what your family deems as realistic. This is not a one size fits all situation. What may be a reasonable budget for one family may not be the same for another.

According to an article by A Debt Free Stress-Free Life with statistics from the United States, “64% make impulse purchases (around Christmas)” and “32% regret how much they spent”.

Don’t be that family that doesn’t budget properly well before Christmas to ensure there is no overspending or impulsive purchases on Christmas eve.

How much money do I need to save for Christmas?

What is a reasonable budget per child for Christmas?

The range at which parents budget per child around Christmas vastly depends on the total income of the family.

Some experts like Dave Ramsay, financial author and radio host, was quoted on Mom.com to suggest that families with a family income range of $50,000 should budget $800 for the entire Christmas budget.

Depending on how many children you have, it’s suggested that you spend no more than $100 per child.

See Also: How to Handle Santa Claus on a Budget

What is a reasonable budget for a Spouse & Immediate family?

If you’re thinking about how much money should I save for Christmas specifically for my spouse and immediate family, first consider your available budget in its entirety.

Ideally, one gift for your spouse and each immediate family member is sufficient. This range will possibly fall anywhere between $100-$300 in total.

How much should I save for coworkers & Friends?

When it comes to budgeting for Christmas gifts specifically for coworkers and friends, it’s important to evaluate how many friends and coworkers you will be getting gifts for.

Once you’ve determined which people you plan on giving gifts to then it’s easier to set aside a strict small budget. Ideally, this should not go over $150 in total, or opt to get everyone a small gift card of the same amount.

Best friends should get more thought-out gifts, while it’s ideal to get coworkers and acquaintances smaller gifts.

How much money should I set aside for Special Events & Christmas Attractions?

When it comes to setting aside money for Special Events and Christmas Attractions either include this as the gift itself for friends or budget this in last.

Many towns and cities offer free Christmas light shows or similar events in the area. This is more ideal than opting to attend a paid Christmas Attraction. When it comes to exact budget set aside a maximum of $100 and instead attend mostly free events to really save.

How can I save money for Christmas all year?

When it comes to saving money for Christmas all year, a great idea that takes little effort is putting aside money each paycheck to your Christmas savings budget.

When should you start saving for Christmas?

The best time to start saving for Christmas is ideally 3 – 6 months before. Ramsey Solutions had created the September Challenge, encouraging and showing readers how to start budgeting in September.

See Also: How to Have a Debt Free Christmas

How can I save $1000 for Christmas by November?

In order to save $1000 by November for Christmas spending, you would need to set aside 100$ a month to reach exactly $1000.

This can easily be done by cutting back on any spending that’s deemed unnecessary like that one streaming platform you insist you’re going to watch something on, but never do.

Saving Money For Christmas Weekly Starting in January

If you choose to save money around January, it’s reasonable to pull out a certain amount of money from each paycheck and set it aside for Christmas.

If you set aside $75 each month until December by the time it comes to gift shopping you’ll have between $600-$900. That’s a crazy amount of money for holiday gifts that takes only a few minutes each month.

See Also: How to Save Money for Christmas

Should I open a savings account just for Christmas?

If you’re tired of wondering how much money do I need for Christmas, you may be considering the idea of opening a savings account specifically for Christmas.

These types of accounts are known as Christmas Club accounts. It was an initiative by many banks for individuals to create savings account specifically for Christmas time. The ideology behind a Christmas Club Account is thoroughly explained by Bankrate in this article.

Unfortunately, this practice is slightly outdated.

How to stretch your money and save this Christmas

When it comes to stretching your money for Christmas, creating a very strict budget and cutting out unnecessary spending is required for saving the most amount of money.

For the months leading up to the holiday season, avoid going out to eat too much and consider cutting back on unnecessary subscriptions you don’t use anymore.

Some individuals opt to create a Christmas budget sheet or envelope where each paycheck a certain amount of money is pulled out and set aside. Usually, this amount is small, and no more than 25$ each paycheck.

See Also: 26 Homemade Christmas Gifts Your Friends & Family will Love

Ways To Add To Your Christmas Savings

There is a triumphant amount of ways to add to your Christmas savings. Some ways to consider adding to your Christmas savings were included in an article by Ramsey Solutions.

- Purchase generic brands when it comes to grocery shopping and you can easily save over a hundred dollars.

- Sell clothes on apps like Poshmark

- Sell used books in Facebook groups or on eBay

- Look for clearance items or deals early on

See Also: Side Hustle Ideas you can do from Home

How much money you save for Christmas depends on a lot of individuals circumstances

Regardless of the amount of money you save, your family will cherish any gift they receive. After all, Christmas is a time to spend with family and friends, not dwell over gifts.

Leave a Reply

Hi, could you please send me the Christmas Holiday Trackers. I tried to subscribe but it didn’t take it.